Content

Ken is a Partner in Marcum’s Advisory & Consulting Services Group with over 30 years of experience in the public accounting profession. Ken serves as the engagement partner on many of the firm’s audit and tax engagements and has overall responsibility for client service to ensure our services are delivered accurately, timely and on budget. Ann Marie is a CPA and tax partner in the Chicago office of PricewaterhouseCoopers, LLP where she specializes in corporate taxation and accounting for income taxes.

What is the 5 major of accounting?

In general, there are 5 major account subcategories: revenue, expenses, equity, assets, and liabilities.

Yes, our rigorous curriculum will prepare you to solve complex accountancy challenges. But more importantly, the solutions you devise to these challenges will be informed by a deep sense of ethics strengthened during your time at Notre Dame. BKL became the first major accountancy firm to acquire B Corp status, increasing its attractiveness to new talent Read More… In May, we unpack the wave of activity in several mid-market firms, as well as the latest moves across regulators and trade bodies Read More… As Menzies becomes the latest accounting firm to launch an ESG service line, Accountancy Age looks at the factors for and again investing in sustainab… ATT Technical Officer Helen Thornley looks at the latest consultation from HMRC about how to improve the processes of testing of new systems and polic…

Top 21 International Alliances and Associations 20…

Prior to rejoining EY in 2016, Chantal spent 2 years as a Manager of IT Internal Audit at Hyatt Hotels Corporation in Chicago, IL. She assisted with leading internal projects focused on IT risk from both a central and property-level perspective. In previous roles, James served on the Operating committee for the Deloitte US Firms, the Americas Executive committee, and the board of directors for the Deloitte Foundation. Previously, Natalie helped develop an assessment of U.S. cities’ vulnerabilities to climate change and their readiness to adapt, at the Notre Dame Global Adaptation Initiative (ND-GAIN).

The Accountancy Age Top 21 International Alliances and Associations 2021 promotes excellence in the accountancy industry worldwide by ranking accounta… DEI initiatives can help accountancy firms put their best foot forward with the youngest generation in the workforce, experts suggest Read More… The new accounting standard provides greater transparency but requires wide-ranging data gathering.

Reporting

Individuals entering the profession can pursue a variety of roles, including financial or managerial accountants, internal or external auditors, or government accountants. “Accountancy” also is often used as an umbrella term to encapsulate several areas of real-world financial statement management, including preparation, compilation and review. Preparing a financial statement or balance sheet is accounting; interpreting it or deciding what to do with it is accountancy. Boards of Accountancy, NASBA, through its Uniform Accountancy Act Committee, provides the Model Rules as recommendations to boards for adoption whereby uniform adoption is encouraged. As such, each individual board may consider the amendment to the Model Rule 5-7 and, if so choose, commence a process to change the rules at the state level. Current Exam candidates remain under existing rules until, if and when, the board to which they applied makes changes.

- Ann started her career at Merit in our Treasury Group as Treasury & Risk Manager.

- He served as the lead partner on many of KPMG’s high-profile multinational accounts, privately held companies, and family offices.

- Qualified accountants measure, disclose and add credibility to organisational data to support decisionmakers in the public and private sectors.

- Boards of Accountancy, NASBA, through its Uniform Accountancy Act Committee, provides the Model Rules as recommendations to boards for adoption whereby uniform adoption is encouraged.

- From uneven income to simply finding the time to manage their personal finances, accountants tend to face more challenges when investing.

- Individual license holders will continue to complete and report 40 hours of continuing education by September 30 each year.

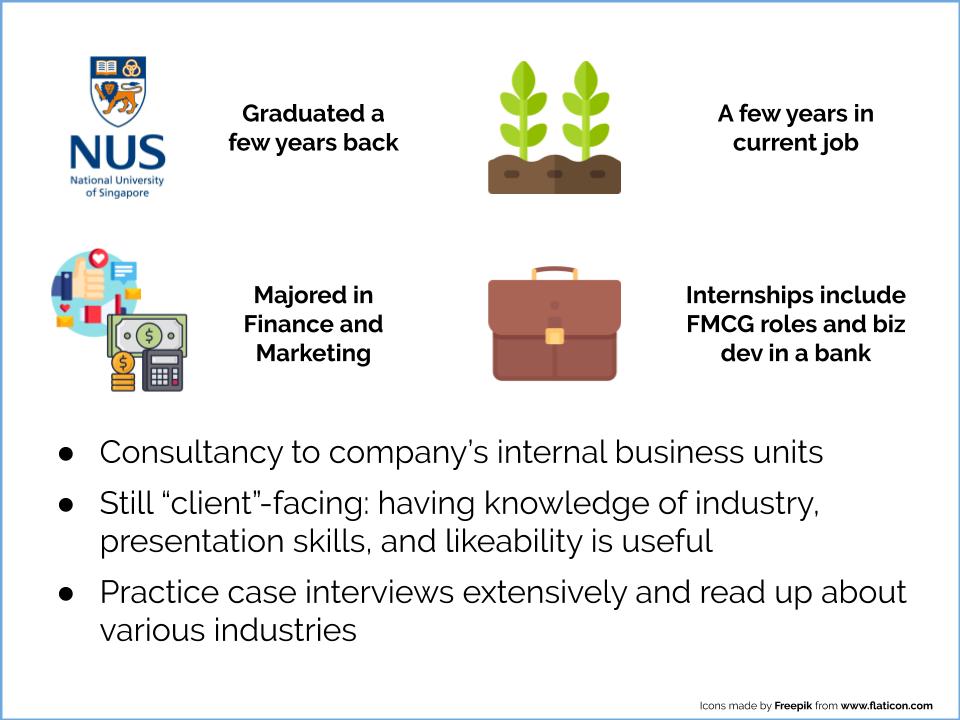

Our consultancy services are based on years of experience in understanding your business. We can help you find solutions to day to day challenges and make major decisions such as buying & selling businesses tax efficiently. The Board of Public bookkeeping for startups ensures accountants follow Massachusetts requirements, rules, and regulations. Our goal is to provide guidance to our licensees and protection to consumers.

Meet Accountancy Europe

Regardless of which term is used, the job market for professionals in this field is promising. Accountants may work as part of an accounting firm or exclusively for a large company. Because of the essential nature of their role, they can work in any number of industries and sectors, including government agencies and nonprofit organizations. I understand this consent is not a condition to attend ESU or to purchase any other goods or services. The Master of Accountancy program is delivered in an online format ideal for working professionals, conveniently featuring six start dates each year. Use Labor’s Central Scheduling System to meet with a representative from one of our boards or commissions.

- The Board does not discriminate in employment on the basis of race, color, creed, religion, national origin, sex, marital status, disability, public assistance, age, sexual orientation, or membership on local human rights commission.

- In May, we unpack the wave of activity in several mid-market firms, as well as the latest moves across regulators and trade bodies Read More…

- Our highly ranked Accounting program provides you with the building blocks you’ll need to analyze, interpret and communicate financial information.

- The Board accomplishes this mission through a framework of examination, licensure, continuing education, accounting standards, investigation of consumer complaints, and enforcement of State law and regulations.

The information in the general ledger is used to derive financial statements, and may also be the source of some information used for internal management reports. There are also a number of business transactions that are non-repetitive in nature, and so require the use of journal entries to record them in the accounting https://www.apzomedia.com/bookkeeping-startups-perfect-way-boost-financial-planning/ records. The fixed asset accountant, general ledger clerk, and tax accountant are most likely to be involved in the use of journal entries. Employment of accountants and auditors is expected to grow 7% from 2020 to 2030, adding nearly 100,000 new jobs during that period, according to data from the U.S.