Content

There are four basic financial reporting principles governed by generally accepted accounting principles . These principles are designed to provide consistency and set standards throughout the financial reporting field. If you wish to be compliant with GAAP, the cost principle should be used. When using the principle cost method, good accounting software is key. Being able to keep all costs consistent over time, as well as house documents for verification, is key.

Following the cost concept of accounting means that unless there are special reasons for doing otherwise, the assumption should be made that the cost of an item is its true value, and all accounting entries should be made at cost. While it’s clear that using the cost principle has its advantages, there are also a few downsides as well. construction bookkeeping For instance, if your business has valuable logos or brands, they would not be reported on your balance sheet. Jim started his business in 2008, constructing a building to house his growing staff. The cost to construct the building was $300,000, but by 2020, the fair market value of the building had increased to $1.1 million.

108 Contracts with nonprofit organizations.

This might be quarterly, semi-annually, or annually, depending on the period for which you want to create the financial statements to be presented to investors so that they can track and compare the company’s overall performance. In 2018, Infosys started reducing the value of these companies using additional amortization and depreciation. As of now, the current value of Panaya and Skava is shown as $206 million in Infosys books. This case shows that companies need to assess their assets regularly and fairly. If asset market value is going down, then in the books, their value needs to be reduced by additional depreciation, amortization, or asset impairment. The first cost principle accounting example is the Google acquisition of YouTube.

These assets cannot be represented using the cost principle because of this. Asset ImpairmentImpaired Assets are assets on the balance sheet whose carrying value on the books exceeds the market value , and the loss is recognized on the company’s income statement. Asset Impairment is commonly found in Balance Sheet items such as goodwill, long-term assets, inventory, and accounts receivable.

Book Value of an Asset and Historical Cost

Charges for work performed on Federal awards by faculty members during the academic year are allowable at the IBS rate. Except as noted in paragraph of this section, in no event will charges to Federal awards, irrespective of the basis of computation, exceed the proportionate share of the IBS for that period. IBS is defined as the annual compensation paid by an IHE for an individual’s appointment, whether that individual’s time is spent on research, instruction, administration, or other activities. IBS excludes any income that an individual earns outside of duties performed for the IHE.

- Fringe benefits include, but are not limited to, the cost of vacations, sick leave, holidays, military leave, employee insurance, and supplemental unemployment benefit plans.

- Costs incurred in maintaining satisfactory relations between the contractor and its employees (other than those made unallowable in paragraph of this section), including costs of shop stewards, labor management committees, employee publications, and other related activities, are allowable.

- Because asset values change constantly, using the cost principle can lack accuracy.

- Welfare benefit fund means a trust or organization which receives and accumulates assets to be used either for the payment of postretirement benefits, or for the purchase of such benefits, provided such accumulated assets form a part of a postretirement benefit plan.

- There is no speculation in the number; anyone can audit the firm’s books and see where the number came from.

A capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation. Goodwill is an intangible asset recorded when one company acquires another. It concerns brand reputation, intellectual property, and customer loyalty. Historical cost is in line with conservative accounting, as it prevents overstating the value of an asset.

Applicability of the Cost Principle

The necessity of contracting for the service, considering the contractor’s capability in the particular area. Necessary expenses to comply with military requirements, are allowable. Minor losses, such as spoilage, breakage, and disappearance of small hand tools that occur in the ordinary course of business and that are not covered by insurance, are allowable. Self-insurance charges for risks of catastrophic losses are unallowable (see 28.308). Recognize the gain or loss in the period of disposition, in which case the Government shall participate to the same extent as outlined in paragraph of this subsection.

What is the meaning of cost principle?

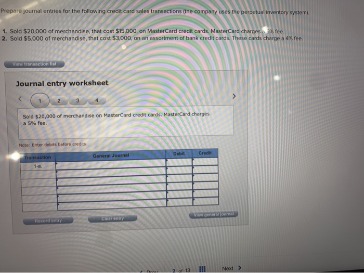

What is the Cost Principle? The cost principle means items need to be recorded as the actual price paid. It is the same way when a buyer buys products, and the recording is done based on the price paid. In short, the cost principle is equal to the amount paid for each transaction.

The assets are recorded at their original cost after accounting for depreciation, if any. Liquid assets, like debt or equity https://www.scoopearth.com/the-importance-of-retail-accounting-in-improving-inventory-management/ investments, are exempt from the cost principle. They aren’t used for any other purpose, like machinery or equipment is.

Costs of promotional material, motion pictures, videotapes, brochures, handouts, magazines, and other media that are designed to call favorable attention to the contractor and its activities. Costs of sponsoring meetings, conventions, symposia, seminars, and other special events when the principal purpose of the event is other than dissemination of technical information or stimulation of production. Costs of keel laying, ship launching, commissioning, and roll-out ceremonies, to the extent specifically provided for by contract.

- Advance agreements may be negotiated with a particular contractor for a single contract, a group of contracts, or all the contracts of a contracting office, an agency, or several agencies.

- Business owners with no accounting background can use cost principles to achieve accuracy, consistency, and simplicity in their books.

- The accounting basis selected for costing each type of leave is consistently followed by the non-Federal entity or specified grouping of employees.

- Bonding costs arise when the Government requires assurance against financial loss to itself or others by reason of the act or default of the contractor.

You can consent to processing for these purposes configuring your preferences below. If you prefer to opt out, you can alternatively choose to refuse consent. Please note that some information might still be retained by your browser as it’s required for the site to function.

On the balance sheet, the work truck is still listed at the original cost of $50,000. In addition to the original cost, the accumulated depreciation is recorded. If assets are always maintained at the original cost, then adjustments are unnecessary. Using the fair value method, costs and assets will continue to fluctuate as the market changes. Asset In AccountingAssets in accounting refer to the organization’s resources that hold specific economic value and facilitate business operations, meet expenses, and generate cash flow. They create the company’s worth and are recorded in the balance sheet.

What is cost in principles of economics?

The cost principle means that when putting an asset or liability on a companies balance sheet, the actual monetary cost of the asset/liability is used. It is sometimes known as the historical cost principle because the cost of purchase is all important. Any change in market value or inflation is ignored.