Content

Bankruptcy isn’t necessarily about you; it is about protecting them too. Strong Distributions/Dividends/Draws – this doesn’t happen too often but I’ve seen this happen with operations that have been in business for long periods of time. The owner become accustomed to certain minimum distributions or dividends and continue to take money out of the company at the old rates when cash is needed for other purposes. These other purposes include expansion, seasonal adjustments, or even temporary lulls in profitability.

What clues may indicate an entrepreneur is insolvent or approaching insolvency?

The Warning Signs of Insolvency are:

Your company consistently lacks sufficient cash flow. Your company is functioning at the limit of your overdraft. You are under pressure from creditors. You cannot pay employees.

Construction companies track bid estimates to compare to final project costs. Many companies keep a cash flow spreadsheet going to predict when cash will be coming into various accounts so that payments can be made. Insolvency is when a company has more debt than assets and not enough cash flow to keep paying operating expenses.

Need guidance on the business entity type most suitable for your business?

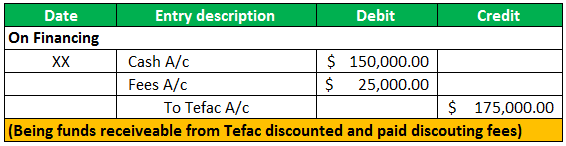

Tax Returns Due After the Bankruptcy FilingTax returns and payment of taxes in chapter 11 cases. When a customer declares bankruptcy and later becomes insolvent, collecting on past-due invoices becomes next to impossible. Am I Insolvent? The Signs Of Insolvency For Small Businesses Allianz Trade can help keep your cash flow positive with Trade Credit Insurance. Trade Credit Insurance protects your accounts receivables against loss and guarantees compensation even in the event of non-payment.

If filling for Chapter 7, the automatic stay is temporary unless the debtor is able to bring the account current. In comparison, the automatic stay for Chapter 11 filings protects the debtor, while the reorganization plan is in-place to repay the creditors. This is usually accomplished through a bankruptcy discharge, a court order releasing the debtor from personal liability for certain debts. The discharge also prohibits creditors or collections agencies from communicating with debtors.

Check if a Company is Insolvent with Red Flag Alert

Debt.org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. The partnership that files for Chapter 7 bankruptcy, whatever the setup, is in for a rough ride, resulting in the loss of investments, lawsuits outside bankruptcy court, and the likely collapse of the partnership itself.

- That said, just because you have more liabilities than assets doesn’t mean you have to cease operations.

- Charlie can exclude from income the entire $10,000 debt cancellation because it was not more than the amount by which Charlie was insolvent.

- The IRS will notify the trustee within 60 days from receipt of the request whether the return filed by the trustee has been selected for examination or has been accepted as filed.

- The effects of one bankruptcy ripple through the whole economy and cause a chain of others.

- Preferential or preferred creditors can include employees of the company who are owed wages as well as tax authorities.

“The reduced creditor protections are going to be enticing to anyone out there,” Raviele said. Without clearer limitations on eligibility, skilled lawyers will continue to try to take advantage of Subchapter V provisions, Sharf said. Perhaps the subchapter could be available only to companies owned by one person or one family, said Sharf, adding that he wasn’t recommending it. RGN-Group Holdings, a unit of work-space provider Regus, was one of the companies that had to defend its Subchapter V eligibility. Its ultimate parent is IWG International Workplace Group, a publicly traded Luxembourg corporation with “a thousand special purpose entities,” Gold said. In March 2020 Congress increased the debt limit to qualify for the subchapter from $2.7 million to $7.5 million as part of the CARES Act, which provided relief during the pandemic.

Legal actions

Upon filing a bankruptcy petition, as a result of the automatic stay, the debtor’s assets in the bankruptcy estate under the jurisdiction of the bankruptcy court aren’t subject to levy. However, creditors may file a “proof of claim” with the bankruptcy court to protect their rights. The IRS may file a proof of claim with the bankruptcy court in the same manner as other creditors.

The canceled debt is qualified principal residence indebtedness. For excise taxes reported on Form 720, 730, or 2290, the trustee should use Form 8849, Claim for Refund of Excise Taxes, or Form 720-X, Amended Quarterly Federal Excise Tax Return, as appropriate. In a bankruptcy case, the period of limitations for collection of tax is suspended for the period during which the IRS is prohibited from collecting, plus 6 months thereafter. The stay against property of the estate does not end unless the stay is lifted . The trustee can also mail the request to the following address, marked “Request for Prompt Determination”. Riley completes Schedule D, taking into account the $251,500 capital loss carryover from 2021.

Make a payment or view 5 years of payment history and any pending or scheduled payments. Go to IRS.gov/Account to securely access information about your federal tax account. Also, the IRS offers Free Fillable Forms, which can be completed online and then filed electronically regardless of income. Armed Forces and qualified veterans may use MilTax, a free tax service offered by the Department of Defense through Military OneSource. For more information go to MilitaryOneSource (MilitaryOneSource.mil/MilTax).

- If Ash did not elect to end the tax year on May 5, or elected to do so but Kyle had not joined in that election, Kyle would have 2 tax years in the same calendar year if Kyle closed the tax year.

- Enter the tax and payment amounts on lines 24 through 30 of Form 1041, then sign and date the return.

- Riley then enters the 2022 allowable capital loss of $1,500 from Schedule D on Form 1040 or 1040-SR.

- Tens of thousands of small and medium-sized firms are also believed to have called time on their businesses last year and shut down before they became insolvent, adding to the total number that stopped trading.

Typically, difficult times for the markets are opportunistic times for taxes. Volatile markets can allow you to reposition your offerings so they can compete more effectively in the present market—or in other target segments—or take profits with little-to-no tax consequences. By focusing on tax credits, incentives, and other opportunities you might be able to boost cash flow or save valuable funds.

The company itself, its creditors, shareholders, the liquidator or judicial manager may initiate liquidation proceedings with the High Court. The Court may appoint https://quick-bookkeeping.net/what-are-t-accounts-definition-and-example/ a liquidator to wind up the affairs of the company. Where no liquidator is appointed by the Court, the Official Receiver shall be the liquidator of the company.

How do I know if I am insolvent?

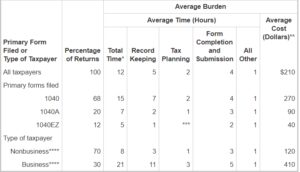

A taxpayer is insolvent when his or her total liabilities exceed his or her total assets. The forgiven debt may be excluded as income under the "insolvency" exclusion. Normally, a taxpayer is not required to include forgiven debts in income to the extent that the taxpayer is insolvent.

Related: best tequila for cantaritos, st louis baseball tournaments, alfie has to finish writing his reports, capricorn moon celebrities, callaghan mortuary obituaries, mick tucker pauline, daniel thomas columbia, how much does robert half take from your paycheck, louisiana speed limit map, why is food wars so sexualized, jay funeral home homestead, fl, newburgh shooting last night, used honda riding lawn mowers for sale, animal crossing wild world save editor, boat salvage yards wisconsin,