Thus, the term credit memorandum indicates that the seller has decreased the customer’s account and does not expect payment. In the seller’s books, a return or allowance is recorded as a reduction in sales revenue. Since the sales account normally has a credit balance, returns and allowances could be recorded on the debit side (the reduction side) of the sales account. The process of recording closing entries for service companies was illustrated in Chapter 3. You may recall that a closing entry is an entry made at the end of an accounting period that is used to close

out a temporary account.

Allowances are reductions in assets based upon uncertainties in the sales process. While there are many types of allowances, the allowance for doubtful accounts is the most common. A company that sells on credit must record an allowance for doubtful accounts. This allowance is an estimate of the company’s accounts receivable balance that it expects Closing Entries, Sales, Sales Returns & Allowances In Accounting will ultimately remain uncollectible. Management determines this estimate by examining historical collection rates and trends in the general economy and industry. Sales returns and allowances is a deduction from sales that shows the sale price of goods returned by customers, as well as discounts taken by them to retain defective goods.

What is the total sales returns and allowances account balance?

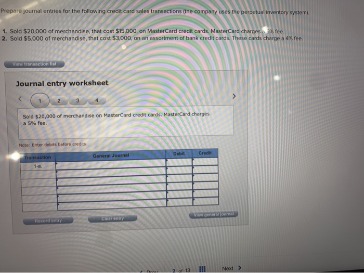

Sales allowances occur when customers agree to keep such merchandise in return for a reduction in the selling price. Record the following transactions in the sales journal and sales returns and allowances journal, and post to the ledger accounts. E3-6 (L03) (Adjusting Entries) Karen Weller, D.D.S., opened a dental practice on January 1, 2017. During the first month ofoperations, the following transactions occurred.1. At January 31, $750 of such services was performed but notyet billed to the insurance companies.2. Utility expenses incurred but not paid prior to January 31 totaled $520.3.

Coco Republic: A store opening, a closing and a reflection on the latter – Furniture Today

Coco Republic: A store opening, a closing and a reflection on the latter.

Posted: Fri, 26 May 2023 13:58:14 GMT [source]

To close these debit balance accounts, a credit is required with a corresponding debit to the income summary. For companies using accrual accounting, this includes both cash payments and payments made on account. The sales account, otherwise known as the revenue account, is found at the top of the company’s income statement.

How to Record a Sales Return for Accounting

A company’s income statement shows the sales, expenses and profits for an accounting period. In the double-entry system of accounting, each financial transaction has at least one debit and one credit entry. Closing entries are part of the accounting cycle, which starts with a financial transaction and ends with the preparation of financial statements. This line item is the aggregation of two general ledger accounts, which are the sales returns account and the sales allowances account. Both of these accounts are contra accounts, which means that they offset gross sales. The natural balance in these accounts is a debit, which is the reverse of the natural credit balance in the gross sales account.

- When merchandise is returned by a customer or an allowance is granted, a credit memorandum (also known as a credit memo) is prepared.

- Closing the accounting system also allow a merchandiser to track activity for a specific period, and then

transfer net income or loss into cumulative equity. - Credit memos serve as vouchers for entries in the sales returns and allowances journal.

- Then, those temporary accounts are reopened for the

following period, again, to report activity for that one specific period.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Prepare a schedule that converts Dr. Accardo’s “excess of cash collected over cash disbursed” for the year 2017 to net income on an accrual basis for the year 2017. His work has appeared in various publications and he has performed financial editing at a Wall Street firm.

8: Closing Entries for a Merchandiser

Closing entries are entered into the general journal, and then posted to the general

ledger. A contra-revenue account is a liability from revenue which helps in determining whether to omit certain sales transactions, which would otherwise be mistaken as revenue. It is usually included if there are any sales returns and allowances or other type of return not recorded in the sales journal. Since the ledger accounts are closed to the General Ledger, this account balance indicates that there are no more invoices in which credits have not been posted. Although sales returns and sales allowances are technically two distinct types of transactions, they are generally recorded in the same account. Sales returns occur when customers return defective, damaged, or otherwise undesirable products to the seller.

The credit part of this entry involves both a controlling account (accounts receivable) in the general ledger and a customer’s account (Champ’s TV Sales) in the accounts receivable subsidiary ledger. However, to improve the bookkeeping process, returns and allowances are often recorded in a separate https://kelleysbookkeeping.com/the-importance-of-bank-reconciliation-in-internal/ account entitled sales returns and allowances. The two accounts may sometimes be combined into a single account in the general ledger. This typically happens when the balances in these accounts are relatively small, so there is no point in tracking returns and allowances separately.

However, at the end of every account period the sales account is closed to equity as part of the closing process. Therefore, the aggregation of sales over the company’s history is found in the equity accounts. In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance. Recording sales returns and allowances in a separate contra‐revenue account allows management to monitor returns and allowances as a percentage of overall sales.

- High return levels may indicate the presence of serious but correctable problems.

- If Music World returns merchandise worth $100, Music Suppliers, Inc., prepares a credit memorandum to account for the return.

- (a) How are the components of revenues and expenses different for a merchandising company?

- These memos may correspond to different customers, different reasons for the credit, or even multiple products/services which have been returned.

- The two accounts may sometimes be combined into a single account in the general ledger.